The House Democrats made the right decision to fire conservative corporate Democrat Cheri Bustos as head of the DCCC after her disastrous performance in 2020-- not that they should have ever elevated her to the job to begin with. But whatever credit they earned by getting rid of her-- and short-circuiting a career track she expected to ride to the speakership eventually-- was immediately lost when they hired a Bustos doppelgänger in a suit and tie. Sean Patrick Maloney is a craven cowardly nothing, a finance industry shill and a member of the corporately owned and operated New Dems. And as utterly clueless about running the DCCC as Bustos was, probably even worse.

Like many conservative Democrats, he's running around hissing that Biden's modest tax increase on corporations is a bad idea-- although he's reading the lay of the land all wrong. Biden's proposal is very popular with the voters-- although not with Maloney's donors-- but he claims Democrats in swing districts may lose their reelection efforts because of the slight tax increase on corporations. Democrats should fire this jackass-- who, until recently, did his own fundraising from the offices of a hedge fund -- before it's too late.

I was glad to see Obama's former Comms Director, Dan Pfeiffer, agrees with me. Even if he isn't publicly telling the Democrats to shit-can Maloney. [If the Democrats want to avoid devastating losses in 2022, they should replace Maloney with someone with a clearer and less self-interested perspective. Ted Lieu would be perfect.] Anyway, Pfeiffer wrote this morning that "There is a nearly one to one relationship between the Congressional Democrats least well acquainted with their own political self-interest and the Democrats most likely to anonymously unburden themselves to reporters. The dynamic reared its annoying head once again on Tuesday morning when the Washington Post reported: 'Pockets of skepticism have emerged within Biden’s party over White House plans to raise the corporate tax rate, revamp the international tax system and double tax rates on wealthy investors, among other measures critical to the administration’s plans... Rep. Sean Maloney (D-NY), chair of the Democratic Congressional Campaign Committee responsible for party fundraising, has privately warned the tax plans could hurt vulnerable House Democrats up for reelection in 2022, said two people familiar with the matter, who spoke on the condition of anonymity to discuss internal matters.' ...[T]his report, combined with the general political anxiety on taxes within the Congressional wing of the party, is a giant blinking red light."

<b>

The idea that Biden’s proposals to raise taxes on corporations and the wealthy are a political liability flies in the face of all of the polling as well as basic common sense. If Congressional Democrats shy away from a tax fight, they will be passing up their best opportunity to upend historical trends and expand their majorities in the midterms.

Before discussing the politics, it’s important to point out that Biden’s tax plan makes complete substantive sense, and it is nowhere near as aggressive or radical as the Republicans, the media, and apparently, some Democrats would have you believe.

As David Leonhardt wrote in the New York Times:

If all of Biden’s proposed tax increases passed-- on the corporate tax, as well as on investment taxes and income taxes for top earners-- the total federal tax rate on the wealthy would remain significantly lower than it was in the 1940s, ’50s and ’60s. It would also remain somewhat lower than during the mid-1990s, based on an analysis that Gabriel Zucman of the University of California, Berkeley, did for The Morning.

This chart from the same story is illustrative of how moderate Biden’s proposal is, as well as why economic inequality has risen so much in the country.

The historical comparison is important because it explains why the hyperbolic Republican rhetoric about the dire consequences of asking the wealthy and corporations to pay just a little more in taxes is so absurd.

Taxes are a Political Winner

The idea that tax fights are good for Republicans is a piece of 1980s era conventional wisdom that seems to still be believed in some circles populated by moderate Democrats. Republicans have lost every single political fight over tax increases since 2008 when Barack Obama took the then-usual step of running against John McCain’s tax plan. Here are just a couple of reasons why Democrats should be confident on the issue of tax increases on the wealthy:

During the Obama years, the Republican Party’s approval rating always dipped when the conversation turned to their opposition to Obama’s plans to raise taxes on the wealthy and close absurd loopholes like the tax exception for private jets (yes, that’s a real thing!).

The central issue in Obama’s landslide victory in 2012 was Mitt Romney’s plan to cut taxes for the wealthy.

In 2017, Republicans passed a massive corporate tax cut which was one of the least popular pieces of legislation in history and was a major reason the party lost 40 House seats in 2018.

Recent polling indicates that the politics for taxes has only gotten better for Democrats. An April Quinnipiac poll found that Biden’s infrastructure plan was nine points more popular when the corporate tax increase was included in the description. Perhaps, even more notably, the plan’s unfavorable rating only went up one point when respondents were informed that it was paid for by an increase in the corporate tax rate.

Let me state that as clearly as possible for the members of Congress with the Washington Post on speed dial-- talking about taxes made lots more people like the Biden plan, and almost no one like it less.

How to Make the Republicans Pay

The Republican Party’s single biggest vulnerability is the contradiction between their dependence on working-class voters and their support for corporatist policies that exploit the working class. Exploiting this vulnerability to break up the Trump-era Republican electoral coalition is the Democratic Party’s number one strategic imperative-- something that is impossible if we don’t aggressively engage in a fight over tax increases for the wealthy and corporations.

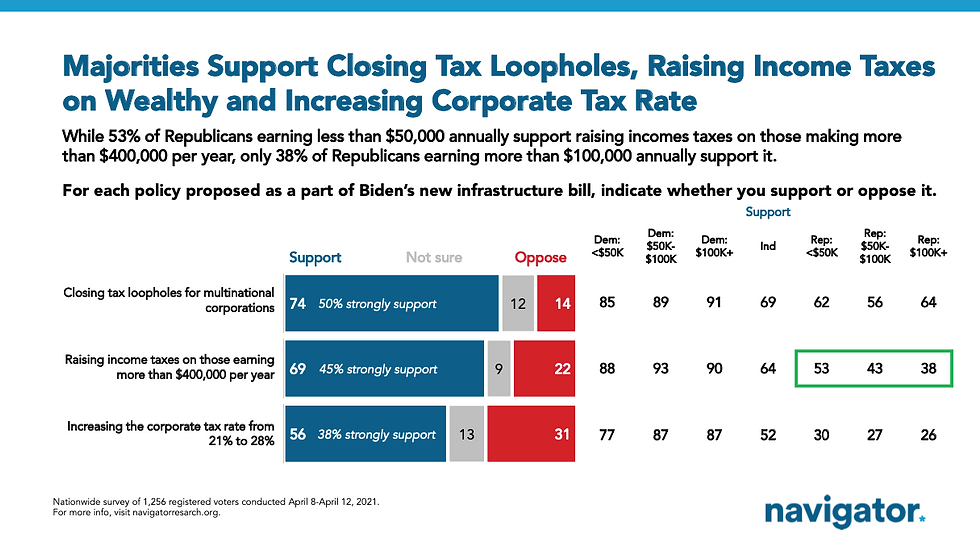

A Navigator poll found that a majority of Republicans that make less than $50,000/year support Biden’s proposal to raise income taxes on those making more than $400,000 annually. These working-class voters that agree with the Democrats on core economic issues are a top target for this messaging. Going soft on taxes means foregoing a chance to win these voters over or at least separate them from the Republicans.

This debate is an opportunity for Democrats to show that Republicans place the interests of the wealthy and corporations above all else-- including their voters. The fact that the Republicans agree with Biden that we must rebuild our roads and bridges makes the argument all the more powerful. Here’s a stab at a message that can work:

Republicans would rather protect tax breaks for big corporations than create good paying jobs by rebuilding the roads and bridges that they agree need to be rebuilt. In fact, the Republican plan ensures that some of the biggest corporations in the world continue to pay zero dollars in Federal taxes. [Republican Candidate X] is unwilling to ask billionaires and hugely profitable corporations to pay ONE MORE DOLLAR in taxes to pay for investments in the middle and working class.

The tax fight also gives Democrats the opportunity to tie Republicans to every single unpopular loophole in the tax code. For example, by opposing Biden’s plan, the Republicans are protecting tax loopholes for companies that ship jobs overseas-- which is the single best testing messaging in every campaign I have worked on in my career. The GOP is choosing to be on the wrong side of this issue. We better make them pay for it.

Fortunately, President Biden does not share the reticence of some in the Congressional wing of his party. He seems enthusiastic about this fight. At a recent event, he vigorously defended his plan when taking questions from the media.

We’re not going to deprive any of these executives of their second or third home, travel privately by jet,” Mr. Biden said after brief remarks on an economic aid program he signed into law this year. “It’s not going to affect their standard of living at all. Not a little tiny bit. But I can affect the standard of living that people I grew up with.”

Our party needs more of this pugilistic populism and less kvetching to reporters like nothing has changed in politics in thirty years.

Bring on the tax fight. It’s one we can-- and must-- win.

Since the 1940's, standing and fighting hasn't been something the Democrats have been any good at. Today the congressional party is a loose, tent-too-big, party of cowards, careerists and compromisers. They're always ready to negotiate away-- internally-- the interests of their own constituents rather than get down in the trenches and fight the right-wingers in the other name-calling fascist-oriented party. Electing leaders like Sean Patrick Maloney is a first step towards disaster.

After meeting with Biden today, McConnell told the media that "We're not interested in re-opening the 2017 tax bill. We [he and McCarthy] both made that clear with the president. That's our red line. This discussion... will not include revisiting the 2017 tax bill." Democratic leaders-- which Maloney considers himself-- should be pushing back on this, not backing it up with misinformation.

Will the democraps fight for anything? Yes. For their donors.

One of the most convoluted confused sentences ever:

"Like many conservative Democrats, (maloney's) running around hissing that Biden's modest tax increase on corporations is a bad idea-- although he's reading the lay of the land all wrong. Biden's proposal is very popular with the voters-- although not with Maloney's donors.."

What is popular with voters has no relevance to what the democrap party will do -- take MFA for instance.

maloney was named BECAUSE he reads the "lay of the land" correctly. His and his party's perspective is and always will be of/by/for the money. His job is to retain as many seats as possible IN SPITE OF his party…