The Alternative Is Not Something Anyone Wants

The billionaires had their panties all in a bunch Friday. Biden was so mean to them during his speech. If only he was as mean to them in real life! Noah Kirsch reported that some of them— basically the conservative billionaires— are raging over the president's suggestion that they need to pay higher taxes. There was a time when the marginal tax rate was over 90% on the super-rich. They should be kissing Biden’s ass for proposing a 25% minimum tax on anyone worth at least $100 million.

Kirsch spoke with real estate billionaire/asshole Jeff Greene, who was in his oceanside mansion in Palm Beach. “Perhaps unsurprisingly, the real estate tycoon doesn’t support Biden’s proposal. ‘I don’t agree with the idea of just singling out people because of how much they have or don’t have,’ he fumed to the Daily Beast. ‘The progressive income tax, I understand,’ he continued, though he argued that tax rates in some parts of the country have already grown out of control. ‘You have to leave incentives for people who are the ones who are going to create the jobs for all those people trying to climb the ladder.’ Greene also contended that wealth can be difficult to measure. Some billionaires, like Mark Zuckerberg or Jeff Bezos, have net worths composed mostly of publicly traded stock, which is easy to value. In his world— real estate— that kind of analysis is often subjective. ‘People speculate about my net worth. I don’t think I can tell you what my net worth is. I have a bunch of assets that are artwork and real estate,’ he said. ‘I mean, do I know every day what it’s worth?’”

Grocery billionaire John Catsimatidis also raged against Biden’s plan when contacted by the Daily Beast for an interview on Thursday.

“I think it sounds like President Biden doesn’t want a capitalist government. He wants a government for socialism. And socialism doesn’t work. Ask the people in Russia, ask the people in Cuba, ask the people in Venezuela,” Catsimatidis said, invoking one of his frequent talking points. (The billionaire hosts his own radio show; recent guests include right-wing Senate candidate Kari Lake, former Trump attorney Alan Dershowitz, and Bill O’Reilly.)

“You’re trying to take away the incentives for people to work hard,” he said. Catsimatidis [———>] added he doesn’t like how the American government doles out taxpayers’ money, particularly on foreign affairs. “I don’t mind supporting the United States’ poor, but you can't support the whole world,” he said.

Billionaire investor Leon Cooperman, meanwhile, said Biden’s proposals amount to “a version of tax and spend where they don’t tackle the real problem.” According to Cooperman, “The real problem is excess spending.”

Biden claimed in his State of the Union address that the 25 percent minimum tax on the ultra-rich will raise $500 billion over 10 years. “Imagine what that could do for America,” he said. He asserted that, on average, the country’s 1,000 billionaires pay just over 8 percent in income tax per year. (The math behind this claim is subject to dispute.)

“I grew up in a home where trickle-down economics didn’t put much on my dad’s kitchen table,” the president also recounted in his speech. “That’s why I’m determined to turn things around so the middle class does well. When they do well… the wealthy still do very well. We all do well.”

Biden, reveling in his allies’ chants of “four more years,” proposed other tax increases as well, including increasing the corporate minimum tax from 15 percent to 21 percent, reducing tax benefits for corporate private jet use, and quadrupling taxes on stock buybacks for companies.

Greene, despite his opposition to Biden’s plan, acknowledged that taxes generally need to increase. “At some point, if you’re not making enough money to pay your bills, either you get less bills or work more hours. Well, same with the government.”

A former Democratic candidate for Senate and governor of Florida, Greene offered other potential ways to generate revenues, such as raising the age of Social Security eligibility over time. “My kids, who are 10, 12 and 14, you could tell them, ‘You know what, when you retire you’re gonna get money at 70, not 65.’” he said. “Do you think they’re gonna care?”

A 10 year old wouldn’t care now, but they would care when they were 67, which scumbag conservatives have already raised it to from 65 (and should all roasted over open fires on TV for their efforts). Look, even if you don’t believe in roasting billionaires on spits, you’ve got to agree the arguments from these greedy, rotten, crooked clowns utterly fail to recognize the fundamental principle of fairness in taxation. Biden says his very modest plan— overly modest— aims to ensure that the wealthiest individuals and corporations contribute their fair share to support vital public services and reduce income inequality. Greene's assertion that singling out the wealthy is unfair overlooks the fact that the ultra-rich have disproportionately benefited from tax breaks and loopholes for years, even decades. Asking them to pay a higher rate is not only reasonable but necessary and long overdue to address growing economic disparities. Catsimatidis' comparison of Biden's proposals to socialism is selfish and misguided, if not deranged. Taxing the ultra-rich at a higher rate does not equate to socialism but rather seeks to rectify the gross imbalance created by decades of policies favoring the wealthy. On top of that, his MAGA-like dismissal of government spending on foreign affairs ignores the interconnectedness of the global economy and the importance of robust diplomatic efforts.

Cooperman's focus on excess spending also badly misses the mark. While controlling government spending is important, it cannot be the sole solution to addressing economic challenges. We all know that taxing the ultra-rich is a crucial step in generating revenue to fund essential programs-- like investing in infrastructure and support struggling communities.

Other billionaires and their lackeys are whining that Biden said the average billionaire pays just 8.2 percent in taxes, far less than a middle class American. “That’s far less than the vast majority of Americans pay,” said Biden. “No billionaire should pay a lower federal tax rate than a teacher, a sanitation worker, or a nurse.”

Alex Demas noted that Brian Riedl, an economist at the right-wing Manhattan Institute said, “No, billionaires do not pay an average tax rate of 8 percent. This has been repeatedly debunked. The president’s math invents its own definition of income, and then calculates their taxes as a percentage of this fake income number.”

“Biden’s 8.2 percent figure,” wrote Demas, “comes from an estimate made in September 2021 by Greg Leiserson, a senior economist in the Council of Economic Affairs, and Danny Yagan, chief economist of the Office of Management and Budget. Leiserson and Yagan measured income by looking at changes in estimated net worth among those listed in the Forbes 400— a ranking of the 400 richest Americans. They then compare these changes to IRS data on total income taxes paid by those on the Forbes list to calculate an effective average federal tax rate.This calculation, however, includes unrealized capital gains (i.e., the change in the value of an asset such as a stock or bond that has not yet been sold) as part of a person’s income. Capital gains— which are not included in conventional measures of income— are typically taxed only after an asset is sold and are generally subjected to a 20 percent rate for high earners, not standard income tax rates. Estimates by the Treasury Department and the Tax Policy Center in 2020 and 2021, respectively, which don’t include unrealized capital gains, estimated that the average federal income tax for the highest-income families in America was 23 and 25 percent.”

Diane Young is a financial planner running for Congress in a Michigan swing district held by a Trump shill. “It is hard,” she told me after the speech, “to feel sorry for someone watching the State of the Union from their yacht while workers in my district are worried about how they’re going to put food on the table next week. John James is more concerned about making his billionaire supporters happy than taking care of his constituents.”

Morris Pearl is chairman of Patriotic Millionaires, which just endorsed Young’s campaign last week. They very much agree on the unfairness of the tax system. He told me that he thinks that “every American should have the same opportunity to build a billion dollar business that John Catsimatidis had. He built a huge business employing thousands of people— and when he was doing it he paid a corporate income tax rate of 48%, and an individual tax rate of 71.75%. The idea that he is trying to tell us that a corporate tax rate of 28% will somehow discourage investment is preposterous. Anyone who has the entrepreneurship abilities of John Catsimatidis is not going to decide not to start a business because, if their business becomes a huge success, they will have to pay a 28% tax rate on part of their profits.”

Billionaires will never agree, but taxing unrealized capital gains would help address the wealth inequality they revere. The current system allows the filthy rich, virtually all of whom are criminals, to accumulate vast amounts of wealth without paying taxes on the appreciation of their assets, exacerbating income inequality. Keep in mind that under the current system— rigged by conservatives in the pay of the billionaire class—wage earners pay taxes on their income, including capital gains from selling assets, while the filthy rich criminals defer taxes indefinitely by holding onto appreciating assets. It’s no stretch to insist that taxing unrealized gains (treating all income sources equally) promotes fairness in the tax code.

I was glad to see Biden ever so gently call out the billionaire class but he certainly didn’t go nearly far enough. Addressing wealth inequality requires systemic change rather than individualistic solutions— structural reforms that challenge the power dynamics perpetuating inequality, including breaking up monopolies, strengthening labor rights and implementing wealth taxes. By challenging the entrenched interests of the billionaire class, society can create a more equitable and inclusive economy that prioritizes the needs of all its members. Catsimatidis’ reactionary argument that extreme wealth disparity is necessary to incentivize hard work has always been used as a justification for preserving the status quo and perpetuating inequality. In reality, the argument does nothing but protect the interests of the wealthy elite at the expense of workers— who also work very hard— and especially workers from marginalized communities. It allows billionaires to continue amassing unprecedented wealth while millions struggle to make ends meet. You know as well as I do that the capitalist system, which rewards excessive wealth accumulation, inherently exploits labor and perpetuates inequality. Billionaires accrue their fortunes not through “hard work,” but often through the exploitation of workers, monopolistic practices, tax avoidance strategies and criminal enterprises. I know a lot of rich people; I would say at least 90% of them are crooks. The concentration of wealth in the hands of a few undermines democracy and perpetuates systemic injustice.

Zach Shrewsbury in the progressive Democrat running for the West Virginia Senate seat Joe Manchin is abandoning. Yesterday he told me that “It comes as no surprise that Washington DC fat cats and their donors are upset over President Biden telling them trickle down economics has failed the nation. It hasn’t failed the billionaire class and they will never want to give an inch to allow the working class any prosperity. That’s why organizing all of us together is so crucial. We can only advocate for ourselves as the working people in America and we must demand that the rich pay their fair share. Though President Biden acknowledged trickle down economics was a failure he also must acknowledge we need dramatic economic reform as well.”

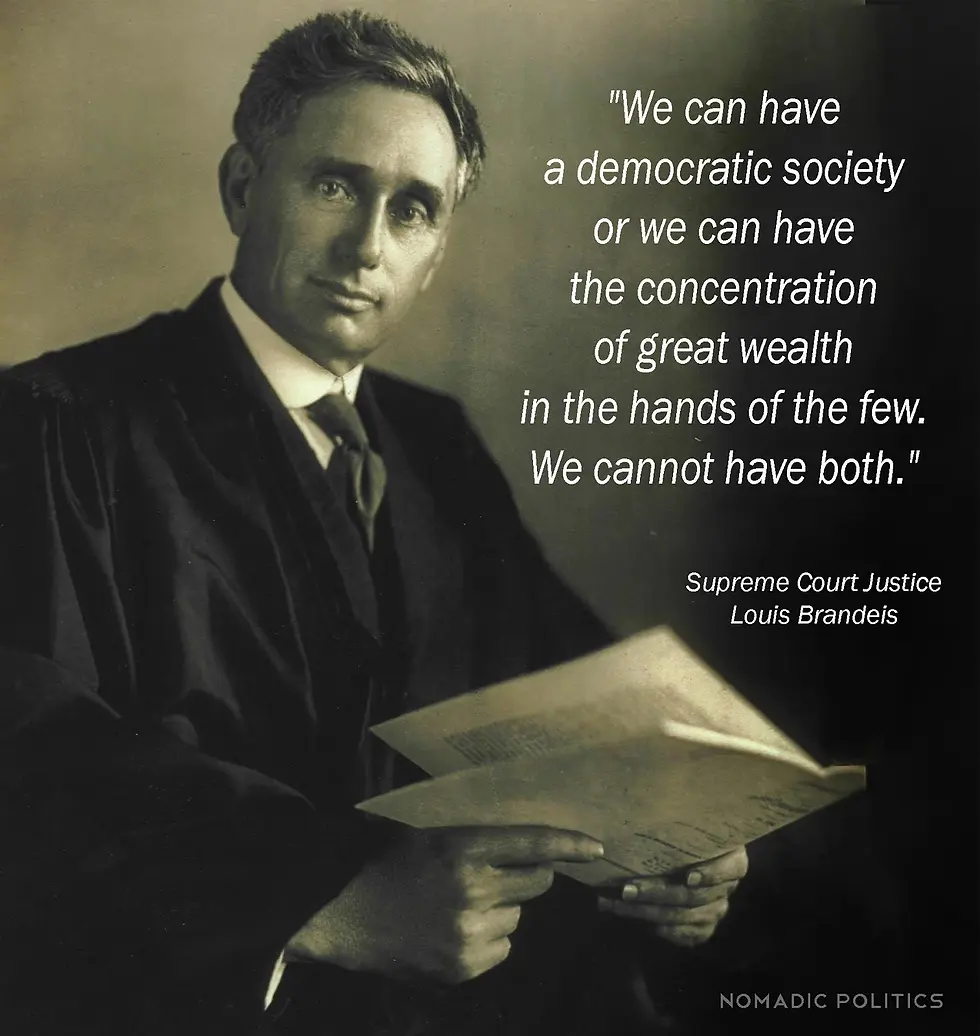

Louis Brandeis is certainly one of the most influential and intellectually gifted justices to have ever served on the Supreme Court, deeply committed to individual rights, civil liberties and economic justice. No one will ever say this about someone like Sam Alito or Clarence Thomas but Brandeis’ brilliance— and ask any reputable lawyer to confirm this— is evident in his keen analytical skills, profound understanding of constitutional principles and innovative approach to legal reasoning. In his day, he was known for his meticulous research, persuasive writing style and willingness to challenge conventional wisdom. His advocacy for social and economic reform, grounded in a deep sense of justice and fairness, still bolsters his reputation as a remarkable jurist. If you have to remember one quote of his, I would suggest “We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we can't have both.” Think about that whenever you fill ion a ballot.

One thing I’ve learned in my 76 years is that extreme wealth inequality concentrates power and resources in the hands of a privileged few, not just depriving the majority of access to essential services and opportunities but betraying the promise of democracy itself. While billionaires enjoy immense political power and luxurious lifestyles, many individuals and families struggle to afford healthcare, education, and housing. This grotesque, unequal distribution of resources is morally indefensible and undermines social cohesion. Contrary to the notion that wealth disparity incentivizes hard work, alternative economic models prioritize equitable distribution of resources and collective well-being. Policies such as progressive taxation, living wages, and worker cooperatives ensure that everyone contributes and benefits from economic prosperity. By shifting focus from individual wealth accumulation to shared prosperity, societies can foster a more just and sustainable economy.

I ran into Ted Lieu, whose Los Angeles district is brimming with billionaires and who just won his Super Tuesday 4-way race with 67% of the vote. I asked him how he felt about this caterwauling from the billionaires after Biden’s speech. He put so simply that even Lauren Boebert would be able to understand it: “If I have a billion cupcakes and have to give a few cupcakes to the government, I still won’t be able to eat all those cupcakes in my lifetime. Totally stupid for billionaires to whine about taxes when they have so much money that most people can’t even comprehend what to do with it all. Are billionaires seriously going to take any hit to their lifestyle if they have $2,600,000,000.00 instead of $2,700,000,000.00? No. Billionaires need to pay their fair share. It’s ridiculous that they don’t do so.”

Excess spending? If the government didn't spend, most of those zillionaires would be considerable less wealthy.

So if a billionaire had to miss a few hundred more million in taxes how would that affect his life? He would still have tons more to spend on whatever. It would have ZERO impact on him in any discernible way. Greed is greed. Robber barons are back. Teddy Roosevelt sure had their number.